Underinsurance is very much a taboo topic in the commercial market despite the devastating effects of misunderstanding the requirements. If you or your advisers don’t correctly assess and understand the nature of the policy and associated risks you can easily find yourself underinsured or even worse, in breach of the policy terms. The fallout is both damaging for the customer and the insurer in terms of their reputation and customer relationships, which explains why this is now a highly monitored area of the insurance industry.

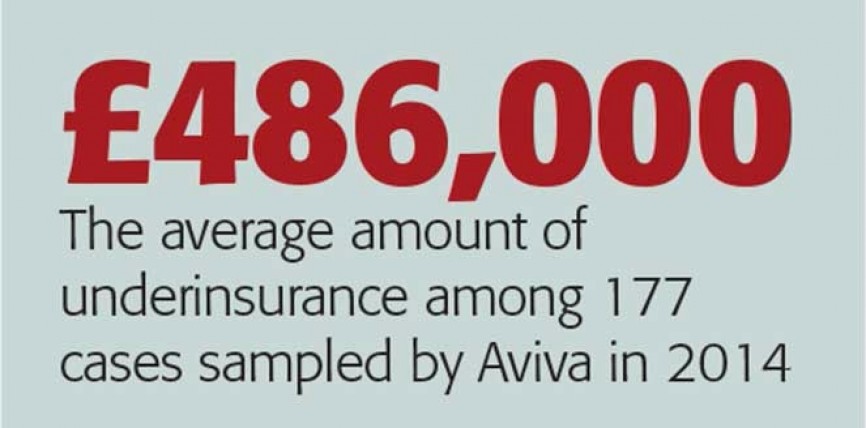

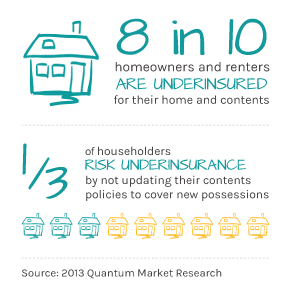

Commercial property is claimed to be the most likely affected by underinsurance according to the Building Cost Information Service. They suggest that 80% of commercial properties could be underinsured by a whopping 60% meaning that for a property worth $1 Million, there will be a short fall of around £600,000. Some attribute this to the consistent effort of property owners to cut costs, meaning that valuations and risk assessments become less important… don’t be one of those people.

Property valuations are essential if you are to buy the correct cover as an estimate is needs to reflect the cost of rebuilding the property rather than its market value price. In reality, many make this very mistake by not incorporating features such as gates and car parks as property value, consequently buying much less cover than actually applicable or needed.

Here at Regency Insurance we know what’s right for you. We are a local insurance firm which has been operating in the area for many years now, which means we can provide a much more tailored service for you. We can help you review your valuations early on as well as checking sub -limits in package policies are sufficient for your individual situation. Cyber risks are a topic customers often misunderstand and/or the covers will be unfamiliar. Regency Insurance always make sure that our clients are fully informed before proceeding with any insurance package, promoting a fair and honest work practice.

In addition to this, we can also provide advice on arranging Business Interruption Insurance and we will guide you on the appropriate sum and period of indemnity.

We can protect your property and your contents from theft, storms, water damage and much more. Give us a ring for advice or a quote we are always happy to help.

emnity” cover?

emnity” cover?